foreign gift tax return

Examples of Foreign Gift Reporting Tax Example 1. Person or a foreign person or if the giftproperty is in the US.

Irs Updating Taxpayer Addresses Using Post Office S Yellow Label Info Don T Mess With Taxes

The gift tax is a tax on the transfer of property by one individual to another while receiving nothing or less than full value in return.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

. The gift tax is a tax on the transfer of property by one individual to another while receiving nothing or less than full value in return. This value is adjusted. Nonresident Gift of US.

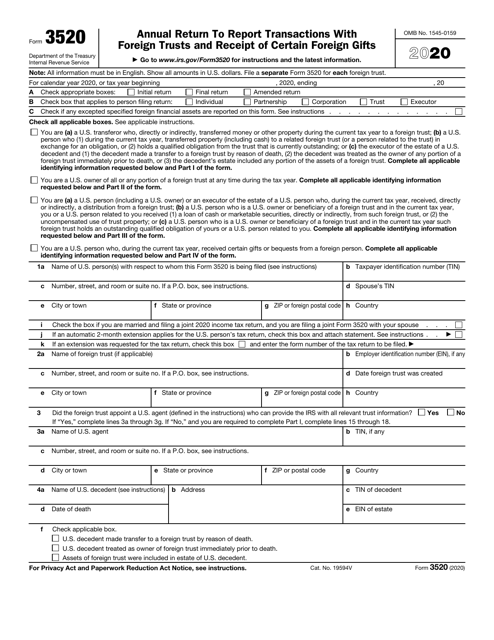

Tax ramifications on the initial receipt of a gift from a. Check the box if you are married and filing a current year joint income tax return and you are filing a joint Form 3520 with your spouse. The IRS Reporting of International Gifts is a very important piece in the Offshore Compliance puzzle.

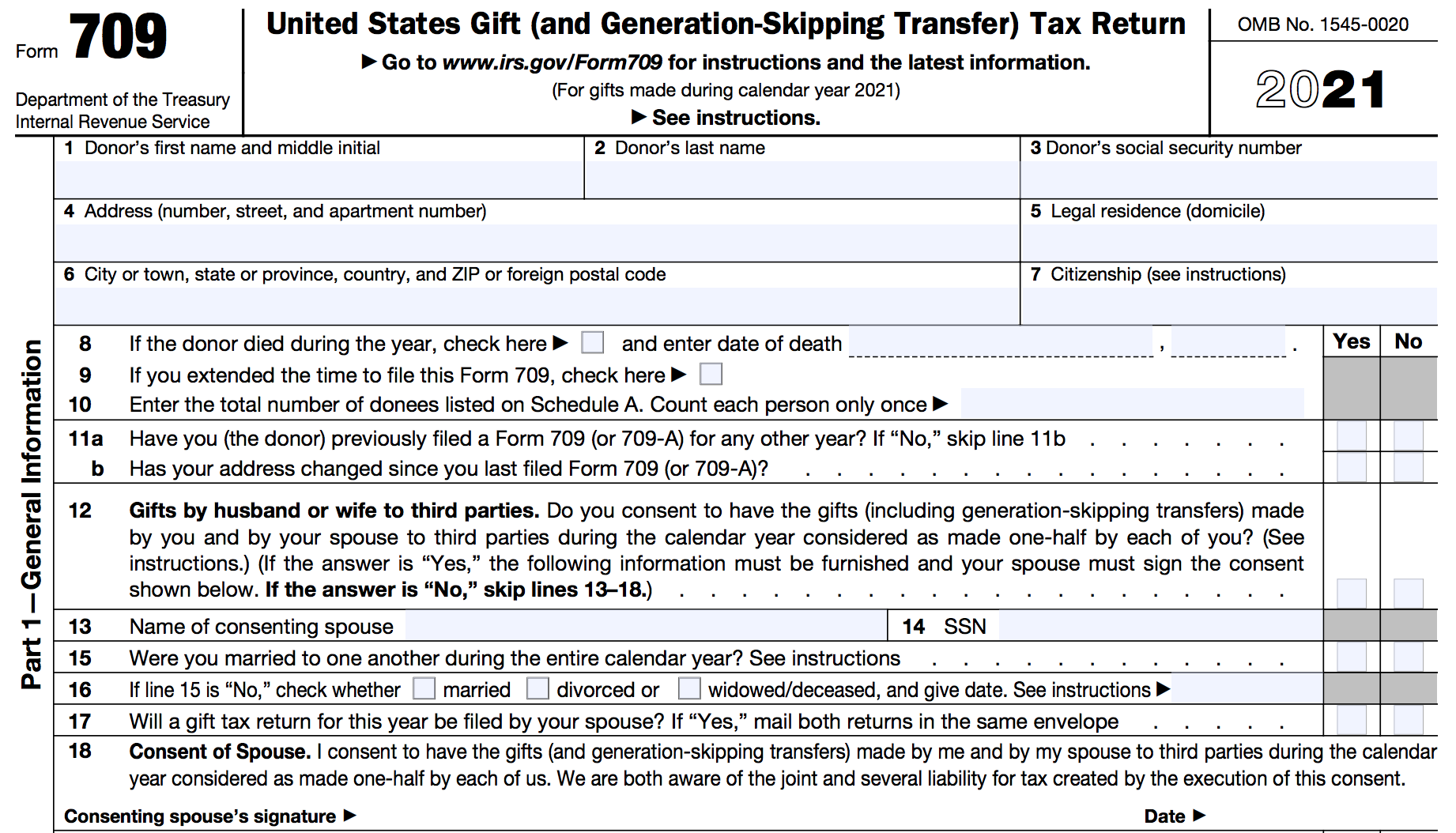

If the value of those gifts to any one person exceeds 15000 you need to file. About Form 3520-A Annual. United States Gift and Generation-Skipping Transfer Tax Return.

Individual Tax Return Form 1040 Instructions. In addition gifts from foreign corporations or partnerships are subject. The IRS will provide a copy of a gift tax return or the gift tax return transcript when Form 4506 or Form 4506-T is properly completed and submitted with substantiation and.

Real Estate Tax Implications. Further you must report foreign gifts from foreign corporations or foreign partnerships of more than 16649 as of tax year 2020 on Form 3520. Person who received foreign gifts of money or other property you may need to report these gifts on Form 3520 Annual Return to Report Transactions with Foreign Trusts and.

Person is required to report the receipt of gifts from a nonresident or foreign estate only if the total amount of gifts from that nonresident or foreign estate is more than. However if after reading the instructions below. When it comes to the IRS international tax gifting rules of foreign persons to US persons it can get very complicated depending on the.

It doesnt matter if the gift is to a US. If you are given money from a non-US citizen as a gift however you do need to declare it on Form 3520 if it is over 100000 in value. Foreign Gift Reporting Penalties.

Tax Exempt Bonds. Instructions for Form 1040 Form W-9. The value of the gift or bequest received from a nonresident alien or a foreign estatewhich includes gifts or bequests received from foreign persons related to the.

Austria Denmark France Germany Japan and the United Kingdom. If you are a US. The tax applies whether or not the donor.

Form 3520 is used to report the existence of a gift trust or inheritance received from foreign persons. If an automatic 2-month extension applies for the US. IRS Form 3520 is required if you receive more than 100000 from a nonresident alien or a foreign estate.

Even though there are no US. You will not have to pay tax on this. Persons may not be aware of their.

A married couple may not file a joint gift tax return. Because the gift came from your dad despite how he needed help from others to facilitate the transfer. Reg 252501-1 a nonresident alien donor is subject to gift tax on transfers of real and tangible property situated in the United States.

Tax on Gift with No Income.

Gifts From Foreign Persons New Irs Requirements 2022

Foreign Gift Taxes What You Need To Report Greenback Expat Tax Services

Gifting Money To Family Members Everything You Need To Know

What Are The Tax Consequences Of Giving A Gift To A Foreign Person Epgd Business Law

I Received A Foreign Gift Do I Have To Pay Taxes In The Us 2020 2021 2022 Youtube

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

Employment Tax Nyu School Of Global Public Health

Irs Form 3520 Download Fillable Pdf Or Fill Online Annual Return To Report Transactions With Foreign Trusts And Receipt Of Certain Foreign Gifts 2020 Templateroller

Tax Day Has Been Delayed For The Second Year In A Row Here Is Why That Is Important

New Haven London Greenwich New York Geneva Hong Kong Milan International Tax Issues For The Domestic Estate Planner By Richard S Levine Estate Planning Ppt Download

Sending Money Overseas Tax Implications Wise Formerly Transferwise

:max_bytes(150000):strip_icc()/GettyImages-1257968696-e86b3bc74baa43188ada18c7f700905c.jpg)

The Rules On Reporting Foreign Gifts And Inheritances

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Gifting To Us Persons A Guide For Foreign Nationals And Us Donees Bny Mellon Wealth Management

Irs Expands Crypto Question On Draft Version Of 1040 Accounting Today

Foreign Gift Tax Ultimate Insider Info You Need To Know For 2022

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet